30+ Mortgage amortization schedule

The calculator lets you find out how your monthly. It also refers to the spreading out.

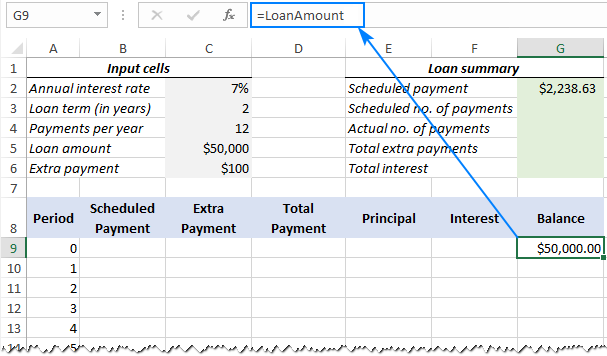

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Balloon Mortgage Calculator With Amortization Schedule excel is used to calculate monthly payment for your balloon mortgage.

. On a reverse mortgage interest charges are added to your outstanding loan balance which then rises each month creating whats called negative amortization. 25 year 30 year 40 year. View annually or monthly.

Calculate interest only and amortizing mortgage payments on the same amortization schedule as well as balloon payments. Amortization is the paying off of debt with a fixed repayment schedule in regular installments over a period of time for example with a mortgage or a car loan. Amortization refers to the process of paying off a debt often from a loan or mortgage over time through regular payments.

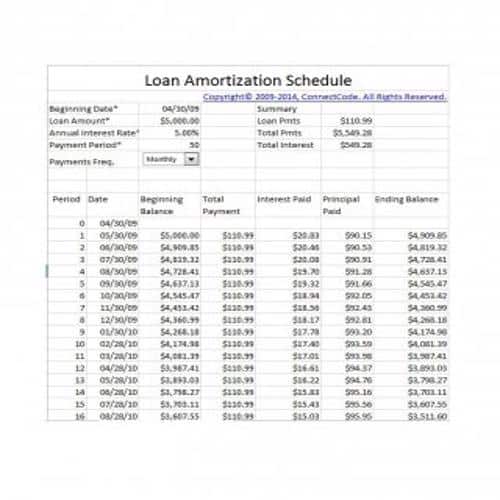

A loan or mortgage amortization schedule is a table that shows borrowers their monthly loan payments. Here you can calculate your monthly payment total payment amount and view your amortization schedule. The balloon loan calculator comes with an amortization schedule that shows each of your monthly payment and the final balloon payment.

This schedule is straightforward and if you have a fixed-rate mortgage consists of equal installments throughout the life of your loan. Lock-in Redmonds Low 30-Year Mortgage Rates Today. What is an amortization schedule.

Auto Loan Payment Schedules. Brets mortgageloan amortization schedule calculator. Determine monthly payments for 5- to 50-year fixed rate mortgage loans.

Now if we took the same example from above but stretched out your repayment plan to a 30-year mortgage your interest rate would probably bump up to 4 and your monthly payment would drop to 1146. By default 250000 30-yr fixed-rate loans are displayed in the table below. Advanced fields include payment frequency compound frequency and payment.

However interest rates for ARMs change at regular intervals so both the total monthly payment due and the mix of principal and interest in a given payment can change considerably at each interest-rate reset. When you take out a mortgage the lender creates a payment schedule for you. This calculator can at least do the math portion to illustrate the power of paying extra and paying off.

Add these values into the calculator fields and. Extra Payment Mortgage Calculator. Yes complete amortization table.

4000 Monthly payments start on. Filters enable you to change the loan amount duration or loan type. Imagine a 500000 mortgage with a 30-year fixed interest rate of 5.

Compare lenders serving Redmond to find the best loan to fit your needs lock in low rates today. Almost any data field on this form may be calculated. Heres what that 30-year mortgage amortization schedule would look like in the first five months.

For Adjustable Rate Mortgages ARMs amortization works the same as the loans total term usually 30 years is known at the outset. Our amortization schedule calculator will show your payment breakdown of interest vs. If your current rate on a 30-year fixed loan is 4000 would you like to see if you can get it lower.

A portion of each payment is for interest while the remaining amount is applied towards the. A 100000 mortgage for a term of 36 months amortized over 300 months at 370 cmpd sa. August 31 2022 Monthly mortgage payments.

30-Year Mortgage Amortization Schedule by Month. The monthly loan payment is determined by the loan amount interest rate and terms. Export to printable PDF andor Excel files.

How much money could you save. Other common domestic loan periods include 10 15. See how those payments break down over your loan term with our amortization calculator.

View complete amortization tables. An amortization schedule is a table detailing each periodic payment on an amortizing loan typically a mortgage as generated by an amortization calculator. Amortization schedule with regular.

See a complete mortgage amortization schedule and calculate savings from prepaying your loan. My Excel template Amortization schedule with irregular payments will solve your mortgage paying off problem in different waysAmortization schedule with regular payment PMT. Financial freedom is actually becoming debt-free.

On a traditional loan you typically have a structured 30-year repayment and the amortization schedule will show a balance that decreases with each payment. An amortization schedule is a complete table of periodic loan payments showing the amount of principal and the amount of interest that comprise each payment until the loan. Calculator allows for 30360 actual360 and actual365 interest methods.

Do you want to pay off your loan or mortgage faster with some extra and irregular payments. If you have any trouble understanding any of the fields hover over the field for a description of the value requested. Loan term in years - most fixed-rate home loans across the United States are scheduled to amortize over 30 years.

For simplicitys sake use the same 200000 loan amount and 30-year fixed-rate mortgage -- but change the interest rate to 4. Calculate loan payment payoff time balloon interest rate even negative amortizations. Enter the appropriate numbers in each slot leaving blank or zero the value that you wish to determine and then.

Principal paid and your loan balance over the life of your loan. If you paid an extra 500 per month youd save around 153000 over the full loan term and it would result in a full payoff after about 21 years and three months. Mortgage Rates Mortgage Rate Trends Updated August 25 2022 Mortgage Calculators Mortgage Calculator.

Balloon Mortgage Calculator With Amortization Schedule. To calculate the monthly payments for a 30-year fixed mortgage with an interest rate of 5 and a principal loan amount. The mortgage amortization schedule shows how much in principal and interest is paid over time.

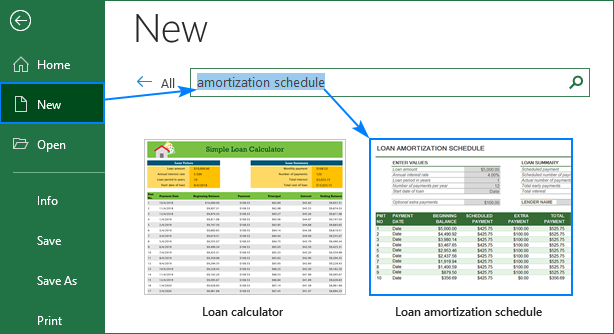

Mortgage amortization is a financial term that refers to your home loan pay off process. Welcome to our commercial mortgage calculator. Calculator Rates Microsoft Excel Mortgage Calculator with Amortization Schedule.

How to Calculate Mortgage Payments in Excel With Home Loan Amortization Schedule Extra Payments. Show Amortization Schedule by. 30 Years Loan amount.

The interest and principal paid the remaining balance and the total interest paid by the end of each month are computed. Mortgage Rates See Mortgage Rates Mortgage rates Todays Mortgage Rates.

Amortization

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Online Loan Amortization Schedule Printable Home Auto Loan Repayment Chart Online Loans Amortization Schedule Payday Loans

Tables To Calculate Loan Amortization Schedule Free Business Templates

29 Editable Loan Amortization Schedule Templates Besty Templates

Tables To Calculate Loan Amortization Schedule Free Business Templates

Tables To Calculate Loan Amortization Schedule Free Business Templates

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

1

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

1

Tables To Calculate Loan Amortization Schedule Free Business Templates

1

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Tables To Calculate Loan Amortization Schedule Free Business Templates