Present value of a stream of payments

How much money must be deposited. NPV is used in capital budgeting to compare whether an investment today will generate positive cash flow in the future.

:max_bytes(150000):strip_icc()/CalculatingPresentandFutureValueofAnnuities3-f5e4d156c37b4fffb4f150266cea32b1.png)

Calculating Present And Future Value Of Annuities

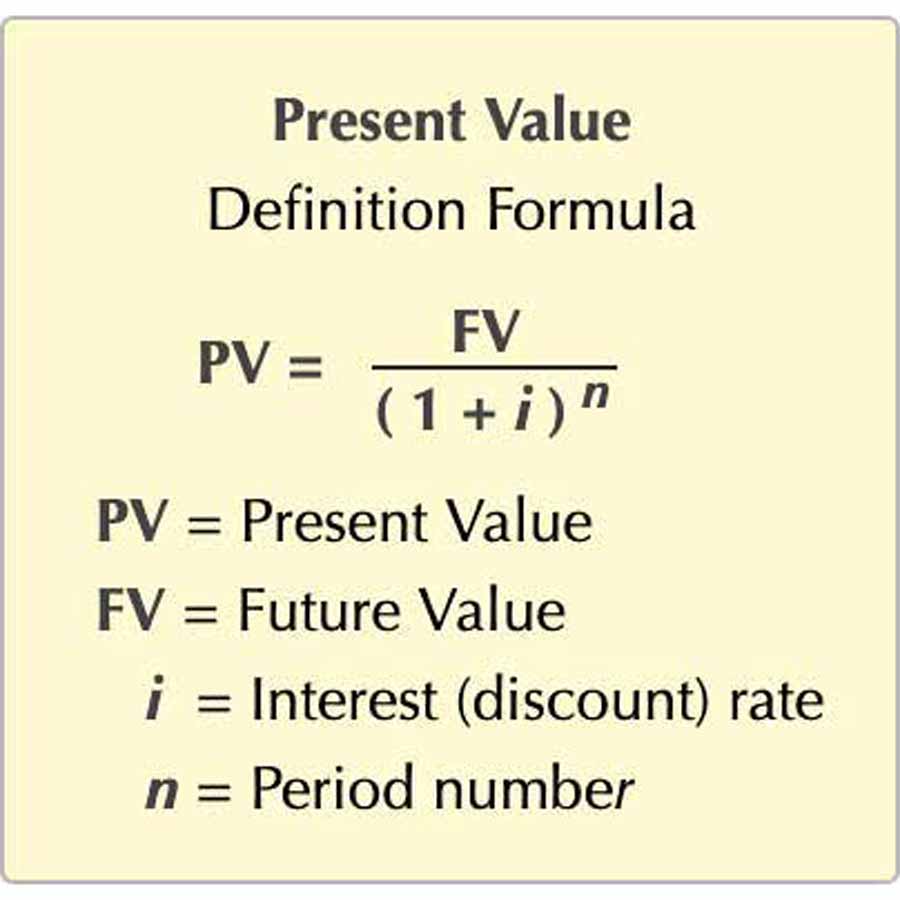

PV FV 1r n.

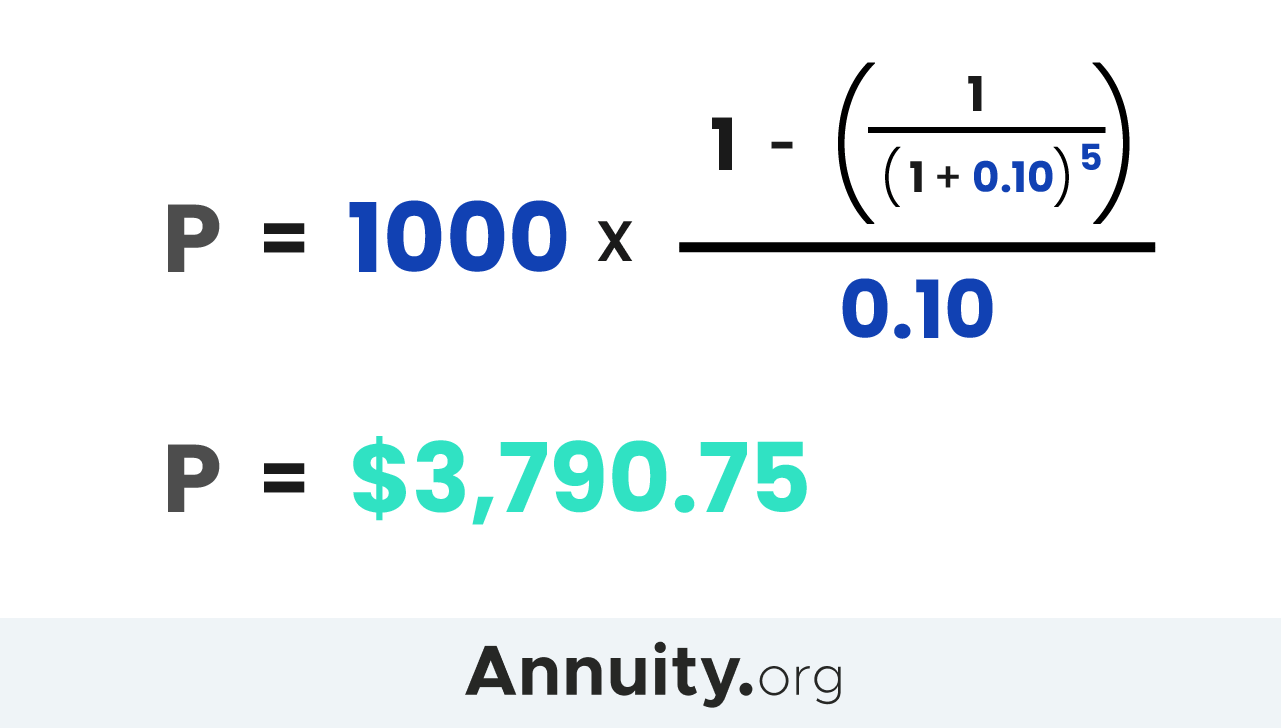

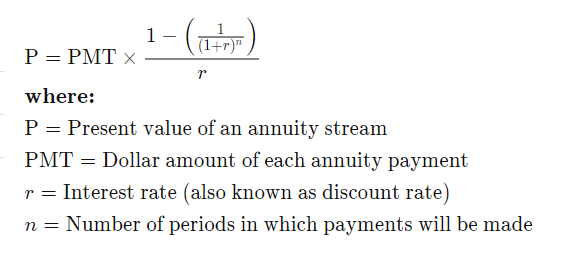

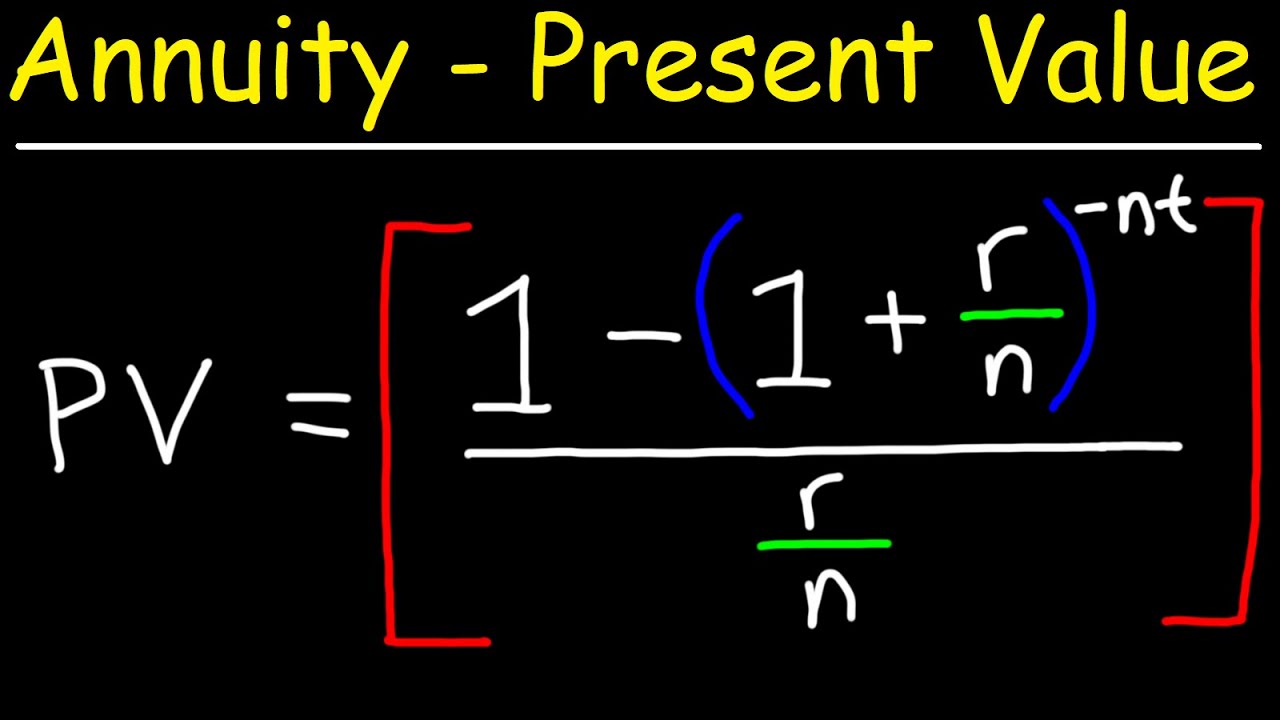

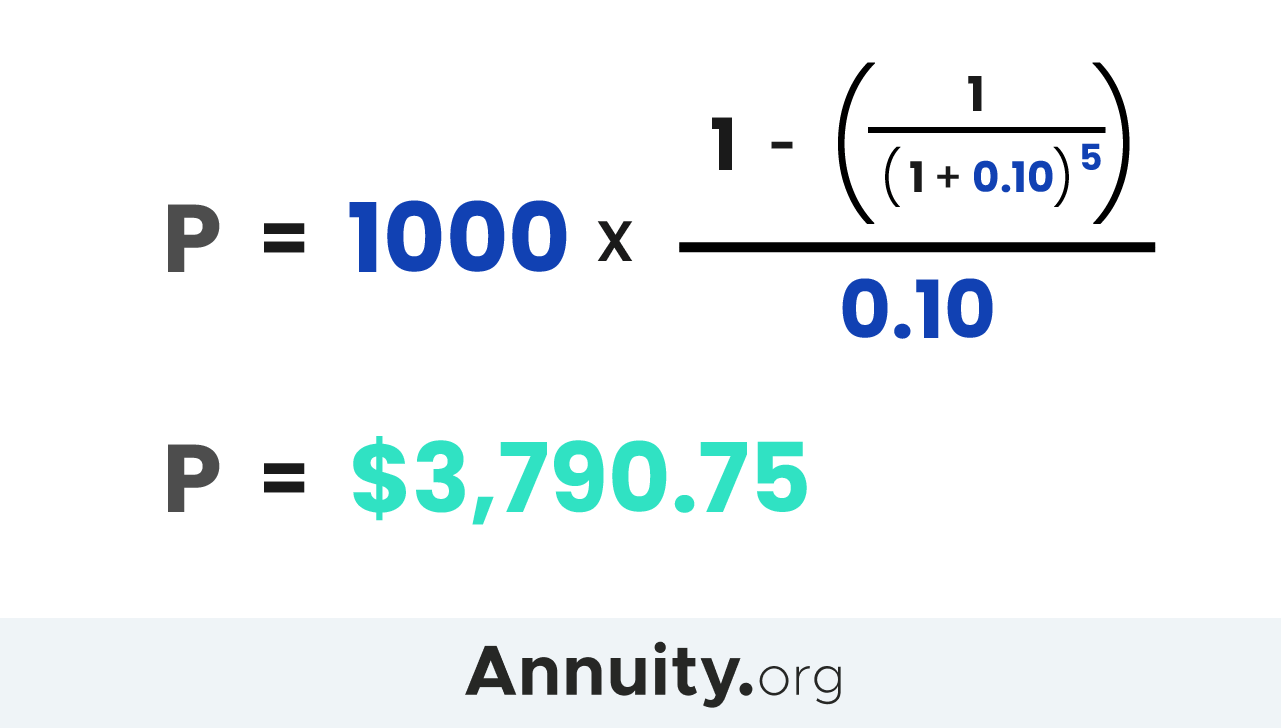

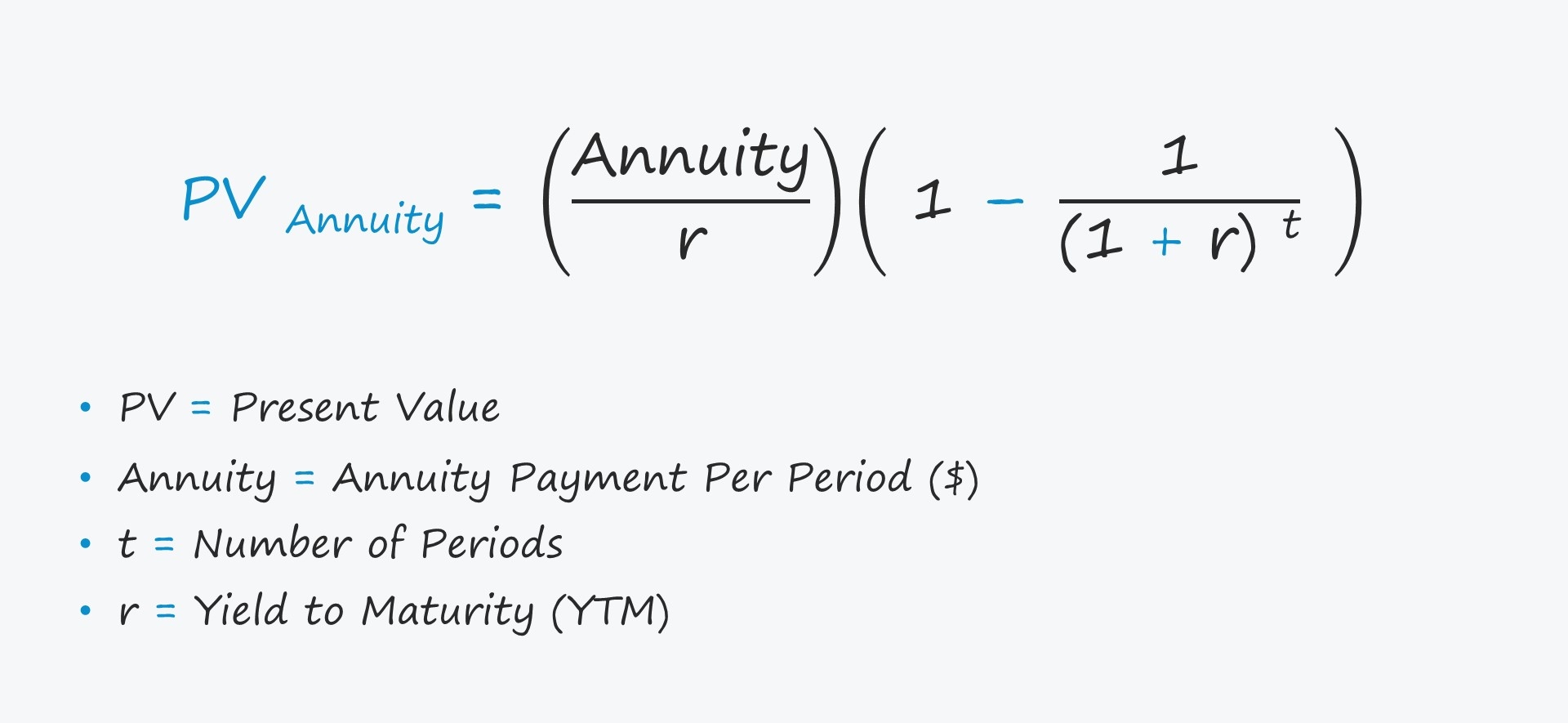

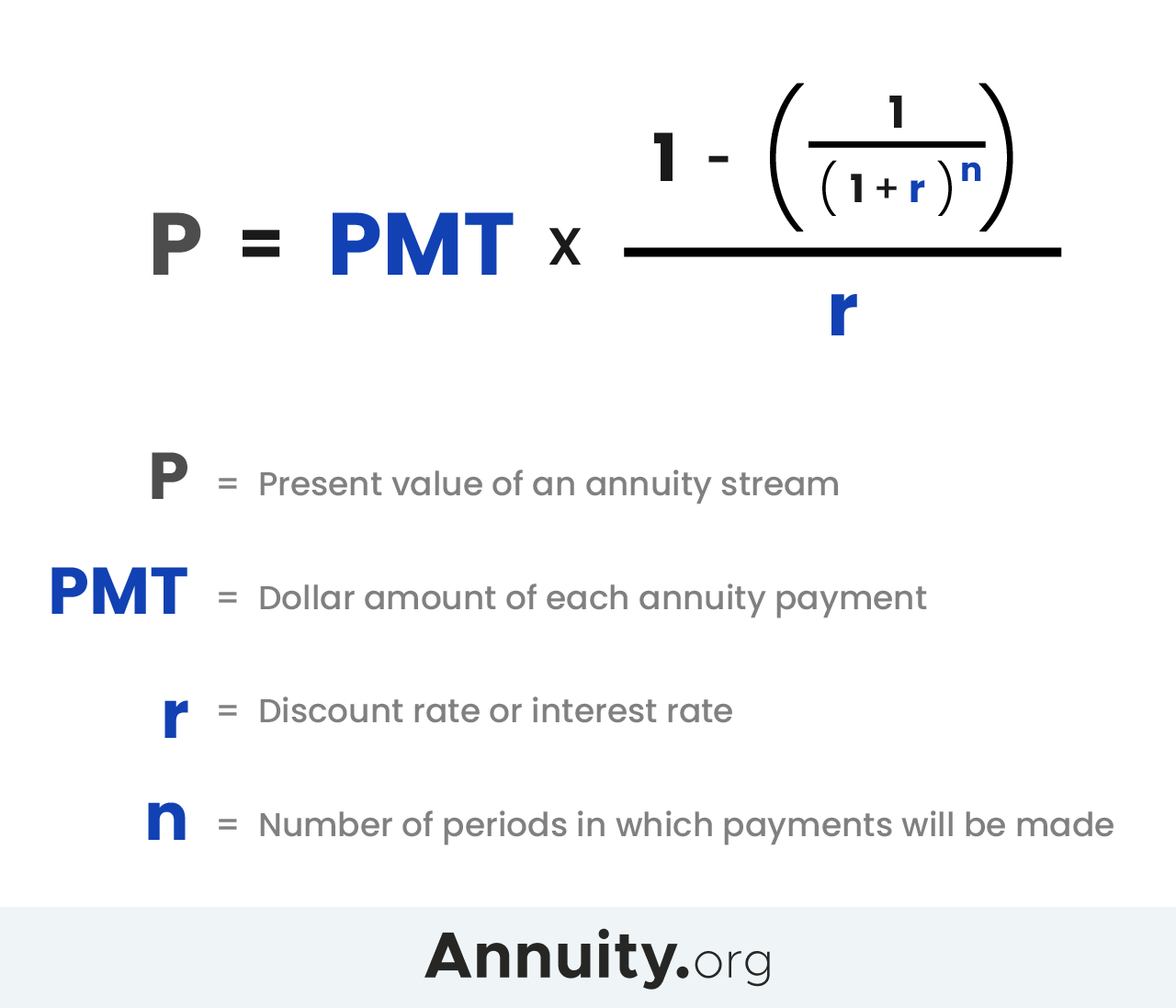

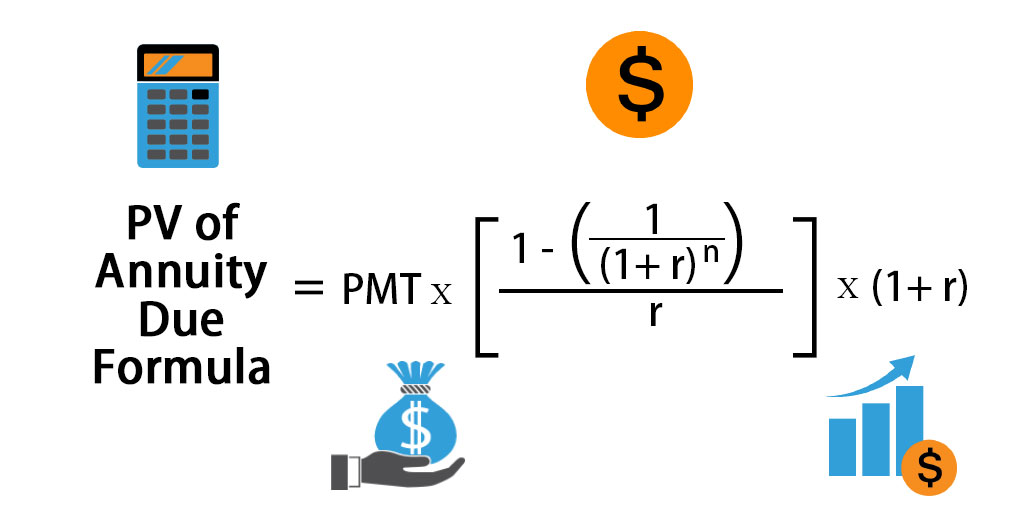

. The formula for determining the present value of an annuity is PV dollar amount of an individual annuity payment multiplied by P PMT 1 1 1rn r where. Meanwhile net present value NPV is the difference between the. Present Value or PV is defined as the value in the present of a sum of money in contrast to a different value it will have in the future due to it being invested and compound at.

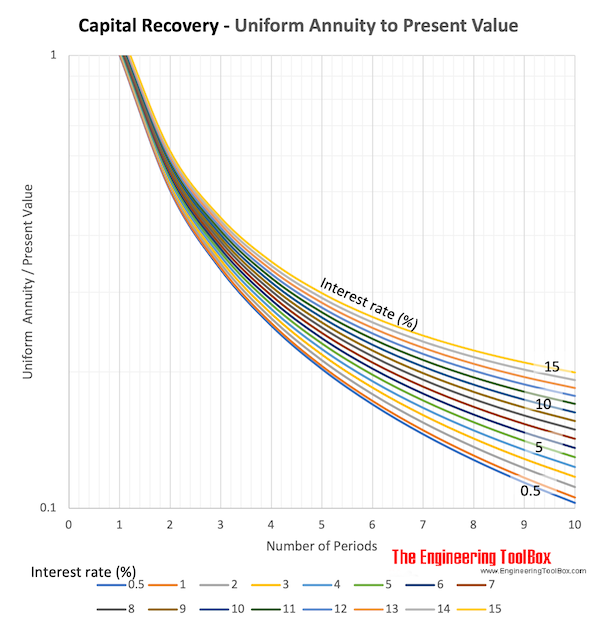

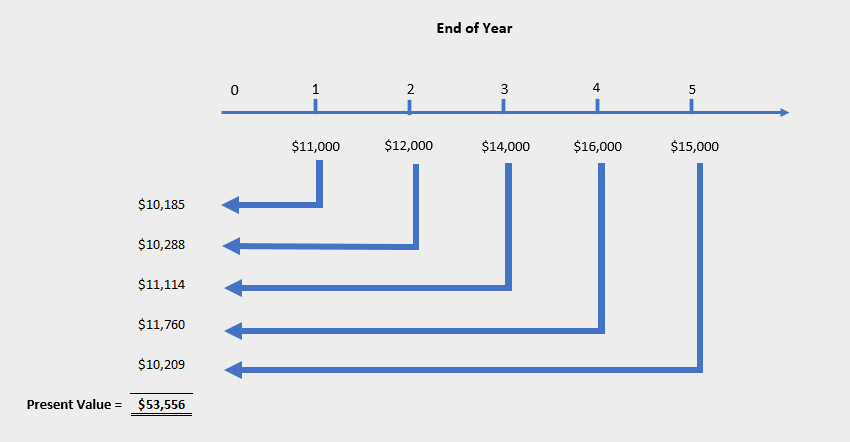

To estimate the present value of any stream of future periodic payments you simply multiply the current annual payment by the present value. If the NPV of a project or investment is positive it. This video shows how to calculate the present value of a stream of payments using Excel.

PV Present value also known as present discounted value is the value on a given date of a payment. PV analysis is used to value a range of assets from stocks and bonds to real estate and annuities. Present Value of Future Money.

These future receipts or payments are discounted using a discount rate which. Present value commonly referred to as PV is the calculation of what a future sum of money or stream of cash flows is worth today given a specified rate of return over a. FV This is the projected amount of money in the future.

Present value is the current value of money to be paid or received at some point in the future. P Present value of your. Credit Card Payoff Calculator.

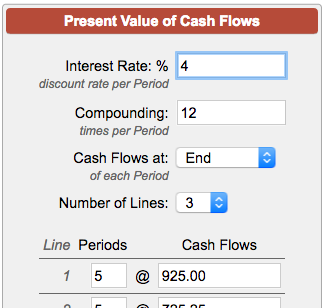

The calculation is actually relatively simple. See Present Value Cash Flows Calculator for related formulas and calculations. Fixed Interest Rate Calculator.

Present value PV is the current value of a stream of cash flows. More specifically you can calculate the present value of uneven cash flows or even cash flows. Credit Card Payment Calculator.

It demonstrates how to do the calculation given a stream of equal pa. What is the present value of a stream of monthly payments of 25 made for 18 years if the interest rate is 6 per year compounded monthly. Present value PV is the current value of a future sum of money or stream of cash flow given a specified rate of return.

Present Value Of Annuity Calculation Knime Analytics Platform Knime Community Forum

Present Value Of Annuity Calculator

How To Calculate The Present Value Of An Annuity Youtube

/CalculatingPresentandFutureValueofAnnuities1-0cea56f3b4514e44bed8f45d9c74011e.png)

Calculating Present And Future Value Of Annuities

What Is Present Value Pv

Net Present Worth Npw Of A Cash Stream

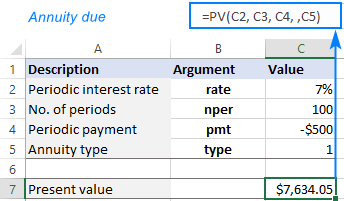

Using Pv Function In Excel To Calculate Present Value

Present Value Of An Annuity How To Calculate Examples

Annuity Present Value Pv Formula And Excel Calculator

Understanding Present Value Formulas Propertymetrics

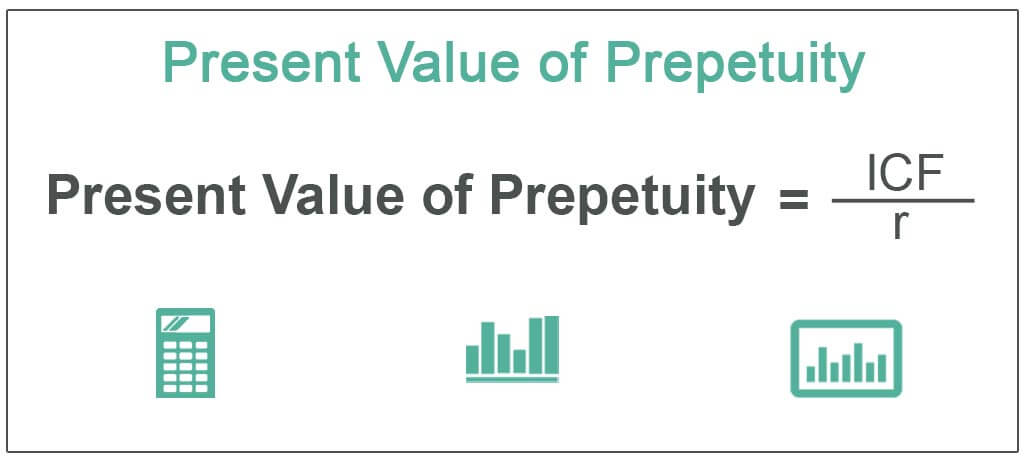

Present Value Of A Perpetuity Formula Double Entry Bookkeeping

Present Value Of An Annuity How To Calculate Examples

Present Value Of Perpetuity How To Calculate It Examples

How To Use Discounted Cash Flow Time Value Of Money Concepts

Present Value Of A Mixed Stream Cash Flow Accounting Hub

Present Value Of Annuity Due Formula Calculator With Excel Template

Present Value Of Cash Flows Calculator